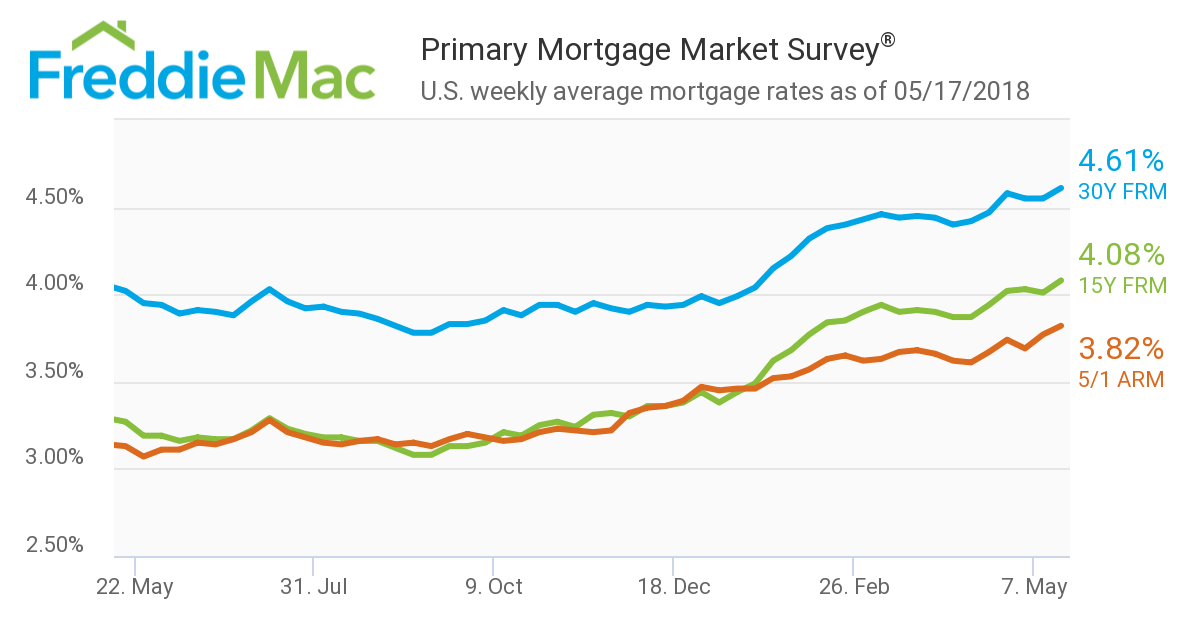

After plateauing in recent weeks, mortgage rates reversed course and reached a new high last seen eight years ago. The 30-year fixed mortgage rate edged up to 4.61 percent, which matches the highest level since May 19, 2011.

Healthy consumer spending and higher commodity prices spooked the bond markets and led to higher mortgage rates over the past week. Not only are buyers facing higher borrowing costs, gas prices are currently at four-year highs just as we enter the important peak home sales season.

While this year’s higher mortgage rates have not caused much of a ripple in the strong demand levels for buying a home seen in most markets, inflationary pressures and the prospect of rates approaching 5 percent could begin to hit the psyche of some prospective buyers.