The current residential real estate market is hectic at best. The inventory of available homes for sale is low. All of this leads to multiple offers on any home that comes to the market.

What can you do to make your offer stand out?

Price: Should you offer more the what the asking price is?

Are homes in your preferred neighborhood selling at list price or above list price?

I will have a current printout of sold homes and where the final pricing of the home was at; i.e. below, at or above the asking price.

Using an Escalation clause:

An escalation clause is a provision added to an offer or counter offer where the buyer offers “X dollars more” than the next highest offer. For example, an offer that states, “The purchase price shall be $1,000 higher than any other offer,” contains an escalation clause. The escalation clause allows the buyer to make the highest offer but only by the minimal amount necessary to beat out other offers.

Here is a more in depth explanation.

Financing

Cash offer: The cash offer used to hold more weight, but today, with pre-approved buyers, conventional offers can be just as competitive as cash. Cash offers have to come in just as attractive to sellers as conventional offers.

Offers utilizing a Mortgage: Having a Pre-Approval letter to go along with your offer is an absolute must if you are going to utilize a loan to buy the property.

Generally, these are the types of letters from a lender that you can get:

- Pre-Qualified Letter: When you prequalify for a home loan, you’re getting an estimate of what you might be able to borrow, based on information you provide about your finances, as well as a credit check.

- Pre-Approval Letter: Preapproval is as close as you can get to confirming your creditworthiness without having a purchase contract in place. You will complete a mortgage application and the lender will verify the information you provide. To get pre-approved you’ll need proof of assets and income, good credit, employment verification, and other types of documentation your lender may require.

- Fully Underwritten Pre-Approval: Pre-underwriting essentially takes the promise of a pre-approval a step further. With this, the mortgage company has already vetted your financials and agreed to give you a mortgage up to a specified price. This time, it is a guarantee. By the time you submit an offer on your home of choice, you’ll have already cleared any conditions that the mortgage company may have and they’ll have given you a firm commitment letter.

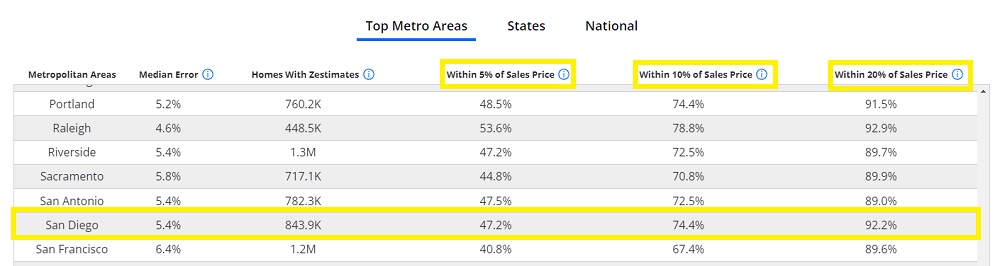

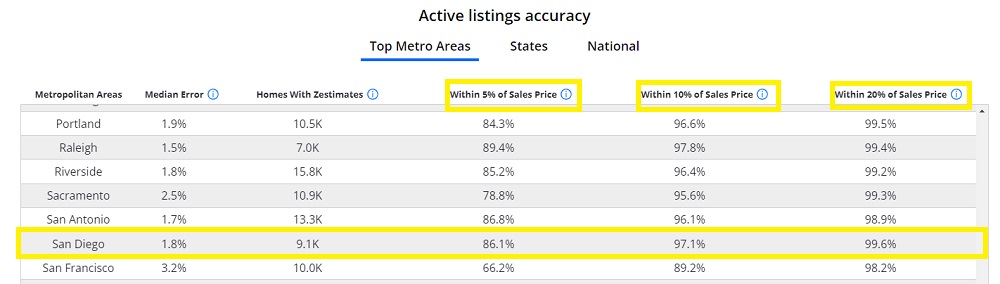

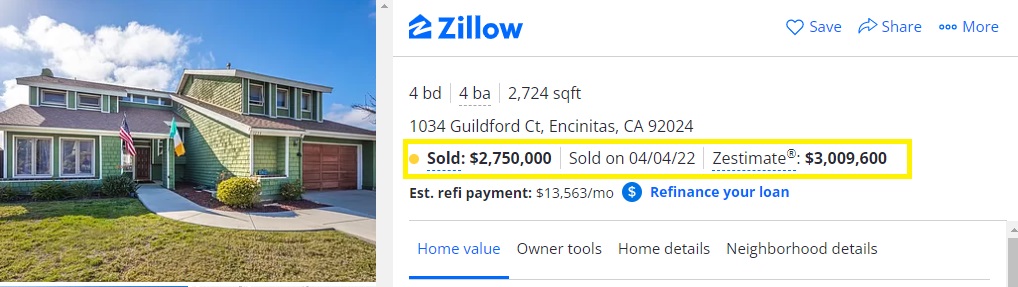

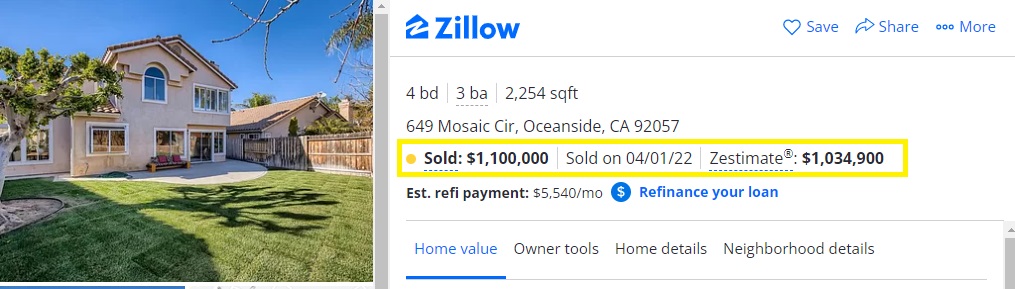

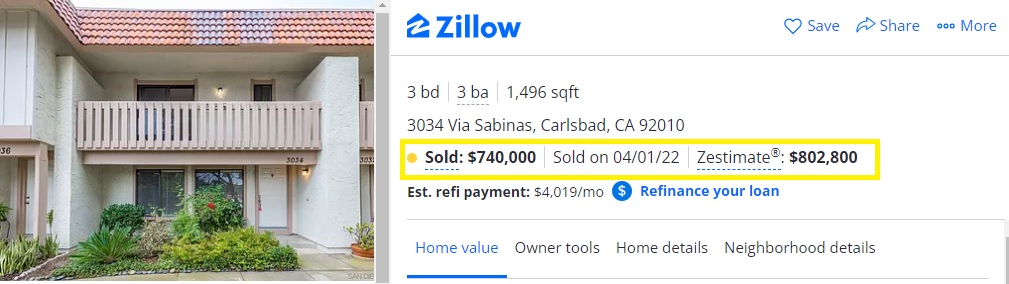

Appraisal contingency

What is an appraisal contingency? : A contingency in a real estate contract is a condition that must be met before closing on a home purchase. The appraisal contingency is a primary contingency that’s included to protect the buyer if the appraisal amount comes in lower than the purchase price.

If the buyer is committed to purchasing a particular house and waiving the contingency could seal the deal, then a waiver could be reasonable.

Waiving the appraisal contingency does not mean there won’t be a home appraisal done, there will be by your lender. Waiving the contingency means that you will be responsible for any difference between the appraisal and the sold price.

An example: The offer on a home is $750,000 and the home appraises for $725,000. In order to close the loan you will have to make up the $25,000 difference if you waived the appraisal contingency.

Inspections

There are a variety of inspections to be done: termite, home inspection, and roof inspections are the most common. The purchase offer calls for 17 days to get these done. The time line to get them done can be shortened to 10 days or 7 days.

Inspections can be waived and done for information purposes only. Any problems found you will deal with after the close of escrow.

Occupancy or when will you take possession of the home

Sometimes the seller needs a few weeks to move out of the home. Asking for immediate possession may be a negative. This is where a good real estate agent can talk to the seller’s agent and find out what the seller needs in an offer. An example on how to use this, you can offer to let the seller stay in the home for 2 weeks rent free to sweeten the offer

Earnest Money Deposit

Read about earnest money here.

Increasing the earnest money deposit to 4% or 5% of the purchase price or more is a way to get the seller’s attention and show the seller how serious you are.

You can make the earnest money deposit non-refundable if you do not close the deal.

There are pros and cons to using these tactics and it all depends on you and your situation as to which ones to use or not use.

If you would like help from a professional real estate broker in this hectic market contact me directly.

Help Me Find a Home