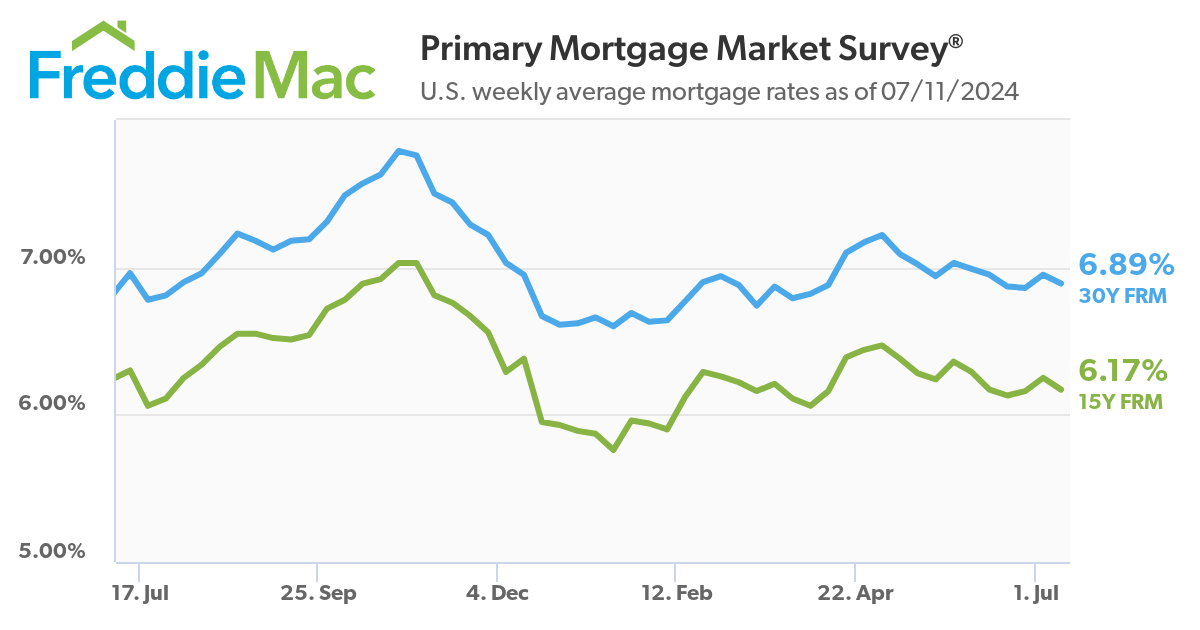

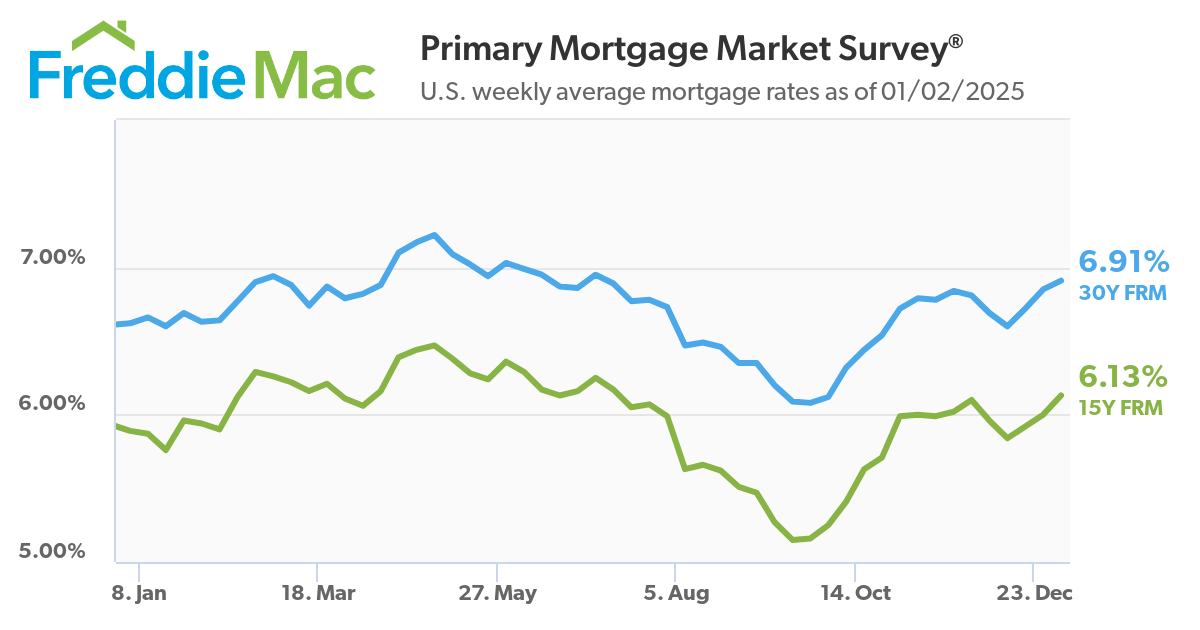

Inching up to just shy of seven percent, mortgage rates reached their highest point in nearly six months. Compared to this time last year, rates are elevated and the market’s affordability headwinds persist. However, buyers appear to be more inclined to get off the sidelines as pending home sales rise.

All content is subject to change without notice. All content is provided on an “as is” basis, with no warranties of any kind whatsoever. Information from this document may be used with proper attribution. Alteration of this document or its content is strictly prohibited. © 2025 by Freddie Mac.