Because pricing your house correctly is so important, I promised to tell you all about what to avoid and how to get it right.

First- what to avoid:

- Advice from friends

- Advice from real estate agents working in a different community

- Zestimates

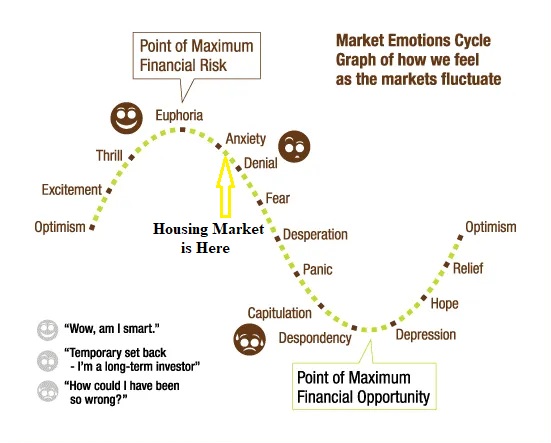

And… please do ignore everything you hear about what your neighbor got for / paid for a house in your neighborhood last year – or even 3 months ago. Markets can and do change rapidly, so those prices have nothing to do with today’s prices.

Your friends probably mean well, but unless they’re agents working in your neighborhood, the information they have will not be accurate. The same is true for real estate agents in other communities.

National news reports national trends, but real estate is always local. Prices are affected by everything from neighboring business, to the jobs market, to the school district, to nearby zoning, to the price of utilities, to views, to access to transportation, and more.

Two neighborhoods less than a mile apart can have very different values.

What about Zestimates? Aren’t they accurate?

No. They have the same problem. The computer program that generates those estimates can compare many things, but has no way to calculate the wide variety of details that affect price. Agents across the country have found that Zestimates can be as much as 30% off the mark – either way.

How can you get it right?

By hiring a real estate agent who is familiar with your neighborhood, and who will prepare a true market analysis, taking all factors into consideration. It’s much the same as a fee appraisal, because it is based on comparison to homes as much like yours as possible. It also takes current market conditions into account.

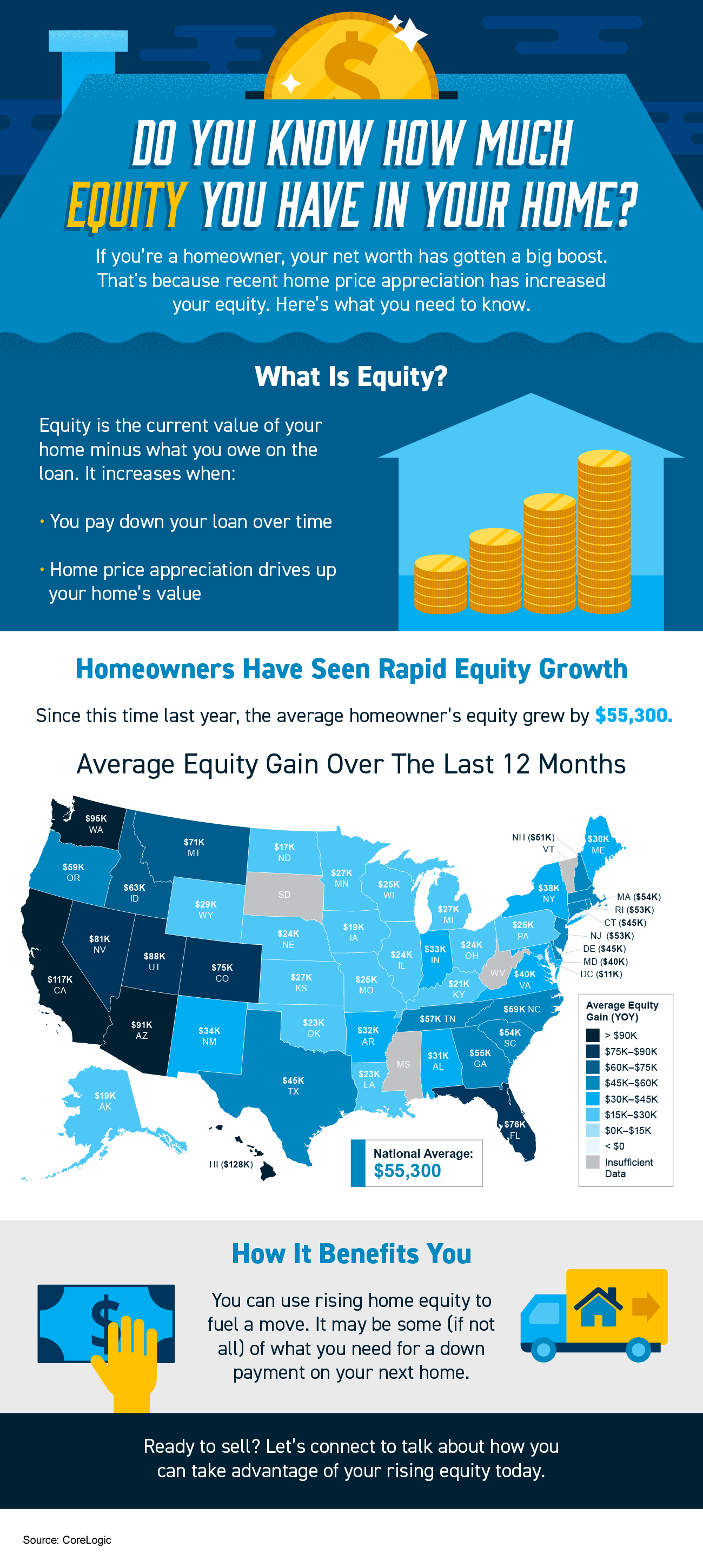

If you’d like to know the current value of your home, get in touch. I’ll be happy to prepare a market analysis, so you know just where you stand.

What is my Home Worth