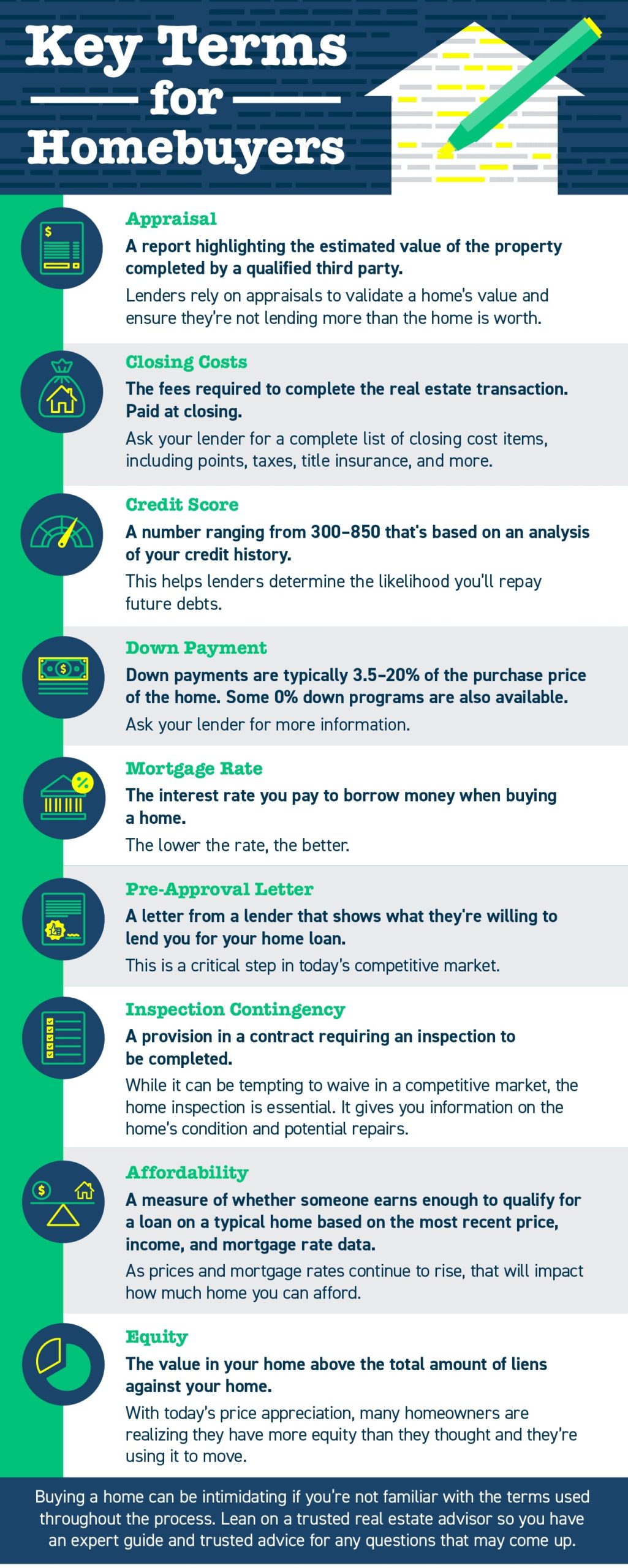

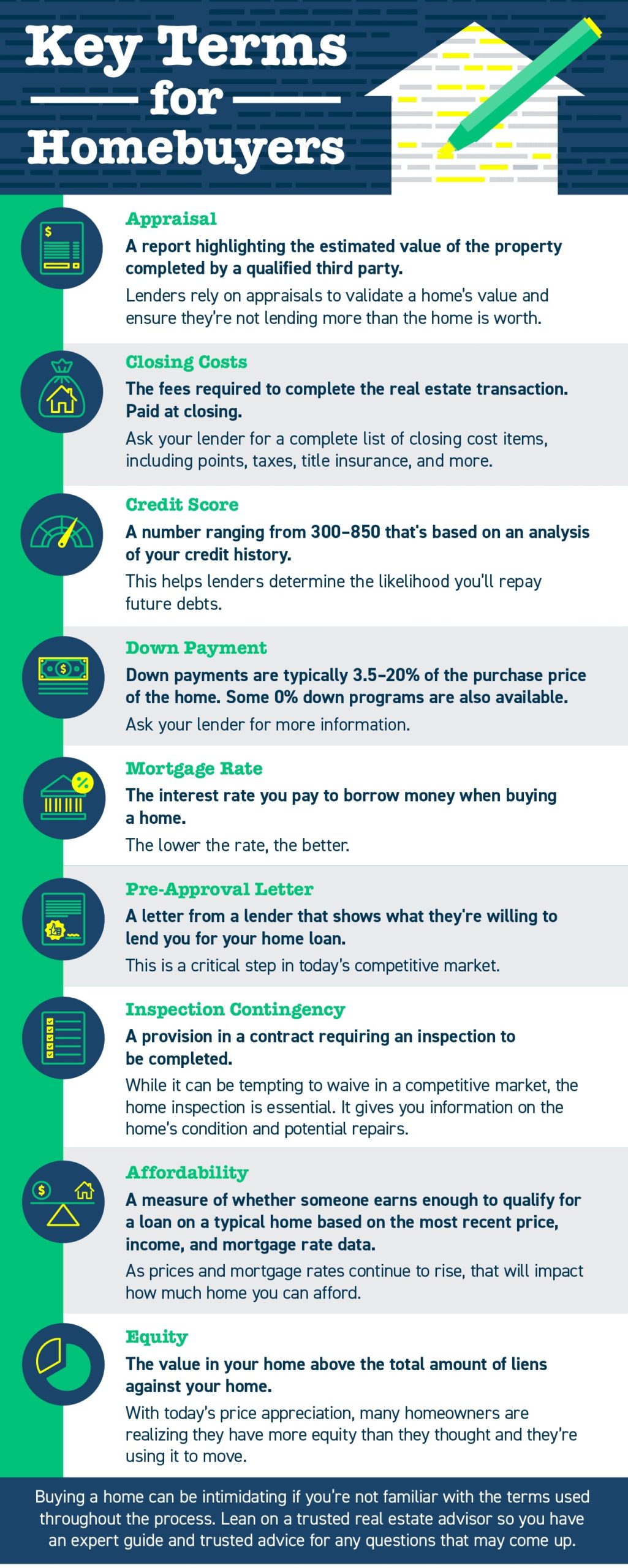

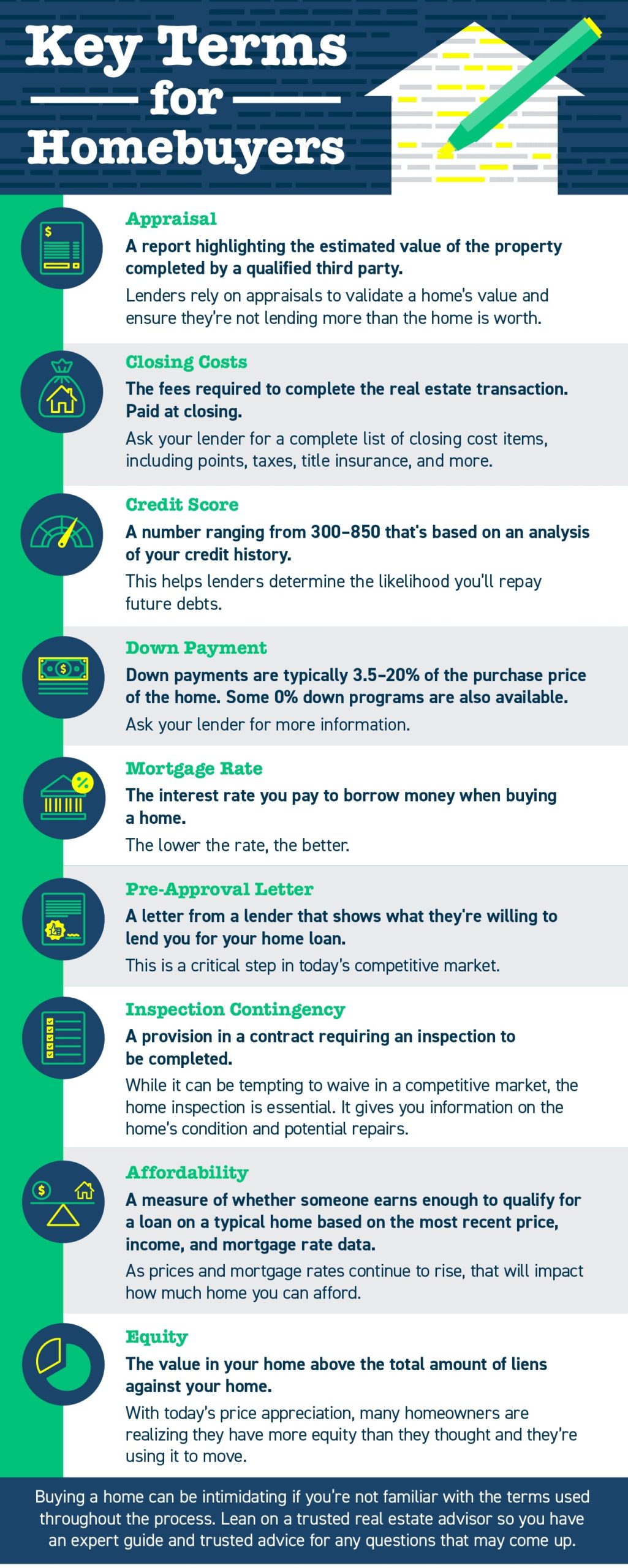

Buying a Home? Terms you Should Know

With advances in technology and new ways to utilize data, some companies have sprouted up to create different ways to sell your property.

Basically, they utilize automated valuation models (AVMs) to make quick offers on homes, allowing

them to close in a much faster than typical timeframe, and then resell them.

From a seller’s standpoint, it can eliminate some hassle and uncertainty, but with high “transaction fees” ranging from 7% to 14%, and the likelihood that they will sell the home for more than they paid you for it, you are simply exchanging that smooth and quick transaction for a portion of your equity.

Companies that offer this kind of service are only in limited markets across the country right now. They operate by having homeowners fill out a short questionnaire with information on their home. They feed that data into their AVM, which kicks back an offer price. They make the homeowner a cash offer to close in a short timeframe (typically about a week) and specify what the fee will be to proceed through to closing. Once they own the home, they will repair and spruce it up, and list it for sale on the open market.

It may be tempting to consider such an offer, but keep in mind that this is a straight numbers play. They are determining a price that allows them the room to cover the costs of the transactions as well as the repairs, while still making some profit. Their profit will either come from the fee you’ve paid or from acquiring your home at a below market price – although it could possibly be a combination of the two.

n analysis on one company’s transactions showed they were selling homes at an average 5.5% appreciation, on top of their transaction fee. That’s a lot of money to leave on the table for a little convenience.

There are other companies beginning to test alternative listing models as well, utilizing technology and AVMs to make ‘instant offers’ on homes, or to help buyers acquire and move into their next home before selling their current one. As always, it’s important to read the fine print and understand what you are agreeing to before using the service.

Hi folks,

If you are going to be selling your home in the near future or are just curious about its value in today’s market, give me a call or use the button below. I will email you a comprehensive market analysis of your home. There is no obligation on your part and it is totally free.

My phone number is 760.476.9560.

What is my Home WorthNot ready to move yet but want to keep an eye on your homes value, I have a monthly update that is customized to your home and neighborhood. Click the link below to see what is included in the report and to sign up:

Monthly UpdateQuick overview of applying for a mortgage loan:

Loan Application 1 to 2 hours:

Application Processing 10 to 30 days:

1) Set Up

2) Review

3) Workup

Underwriting 2 to 3 days:

Submit completed loan package for approval – Normally 48 hour turn around. The loan is approved or rejected. Loan approval may be with conditions to be met before loan funding

What is loan underwriting?

Mortgage loan underwriting is a process involving the analysis of your income, assets and credit to determine if you meet the requirements for the mortgage product you are applying for. The underwriter also focuses a great deal of attention on the home that is being financed to make sure the value is sufficient, the home is safe and habitable and the title of the property can be transferred without any issues like prior tax liens, judgments or zoning problems.

The foundation of loan underwriting is built on a concept called the 3 C’s of underwriting. The factors are credit reputation, capacity to repay loan and collateral, appraisal value of home + down payment.

Title 1 to 3 days:

Closing of Escrow:

This is the question many potential buyers are facing right now.

Do I wait to see if prices go lower?

Do I wait to see if more good homes come on the market?

Do I wait to see if interest rates move lower?

OR…

Is right now the golden opportunity I have been waiting for as there are plenty of choices, sellers are motivated, and interest rates are low.

The first and most important question any buyer needs to ask is: “What do I want?”

Do I want a home?

Do I want a place to live?

Do I want an investment?

Do I want ………..?

WHAT DO I REALLY WANT AND WHY??

It is critical that every potential buyer gain clarity around what they want and why. Here is what we know about buying a home today.

1. There are some incredible values available in the market at this time.

2. It is vital that you work with a great lender to make sure you can get the loan you need.

3. Prices are not likely to soften much going forward.

4. No one has the ability to time the market.

5. Real estate is a great long term investment.

If you can live with the statements listed above and you are looking for a place to call your home for at least the next 5 – 7 years…..

Pick the home that feels the most special and make an offer that makes financial sense to you. There is no point in worrying about what prices are going to do in the short rum. This is something that is out of your control. Buying a home as a short term investment is a risky venture in any kind of real estate market, up or down.

Again….

If you want to know if NOW is the right time to buy….

Take the time to really answer the question – What do I want and why relative to buying a home?

The answer to this question will give you the freedom to move forward with great confidence whether you decide to buy now or wait.

Please do not hesitate to call me with questions about the market or if you would like to start the process of finding and buying the right home for you.

Help Me Find a HomeFor more info on how I can help you find and buy a home, get my Buyer Assistance Pack:

Buyer Assistance PackFirst of all, what is the Zestimate?

Zillow is using an AVM ( Automated Valuation Model) to come up with your home’s value. AVM’s are a service that can provide real estate property valuations using mathematical modeling combined with a database. Most AVMs calculate a property’s value at a specific point in time by analyzing values of comparable properties. Some also take into account current asking prices, previous surveyor valuations, historical house price movements and user inputs (e.g. number of bedrooms, property improvements, etc.)

An AVM typically includes:

Besides Zillow, lenders, appraisers and mortgage investors use AVMs in risk management fields, estimating home equity, and quickly coming up with approximate property valuations in a portfolio. Fannie Mae now purchases qualified homes without an appraisal only using and AVM value.

So how accurate are AVM’s and Zillow in particular?

According to Zillows website here is how accurate their off market Value is:

Active listings accuracy:

Here are 3 recent sold properties with the sale price and the Zestimate:

The Zestimate is off from 6 – 9%. Overvalued 2 properties and undervalued 1. According to Zillow itself, their off market valuation is significantly worse then the active listing valuation. That is because they get a lot of help from a real estate brokers listing price to dial in the value.

I don’t doubt that AVM’s will get more accurate in the future, but for now, the Zestimate is only that, an estimate.

If you are going to sell, get a professional Real Estate Brokers price opinion to dial in your homes value.

What is my Home WorthThe current residential real estate market is hectic at best. The inventory of available homes for sale is low. All of this leads to multiple offers on any home that comes to the market.

What can you do to make your offer stand out?

Price: Should you offer more the what the asking price is?

Are homes in your preferred neighborhood selling at list price or above list price?

I will have a current printout of sold homes and where the final pricing of the home was at; i.e. below, at or above the asking price.

Using an Escalation clause:

An escalation clause is a provision added to an offer or counter offer where the buyer offers “X dollars more” than the next highest offer. For example, an offer that states, “The purchase price shall be $1,000 higher than any other offer,” contains an escalation clause. The escalation clause allows the buyer to make the highest offer but only by the minimal amount necessary to beat out other offers.

Here is a more in depth explanation.

Financing

Cash offer: The cash offer used to hold more weight, but today, with pre-approved buyers, conventional offers can be just as competitive as cash. Cash offers have to come in just as attractive to sellers as conventional offers.

Offers utilizing a Mortgage: Having a Pre-Approval letter to go along with your offer is an absolute must if you are going to utilize a loan to buy the property.

Generally, these are the types of letters from a lender that you can get:

Appraisal contingency

What is an appraisal contingency? : A contingency in a real estate contract is a condition that must be met before closing on a home purchase. The appraisal contingency is a primary contingency that’s included to protect the buyer if the appraisal amount comes in lower than the purchase price.

If the buyer is committed to purchasing a particular house and waiving the contingency could seal the deal, then a waiver could be reasonable.

Waiving the appraisal contingency does not mean there won’t be a home appraisal done, there will be by your lender. Waiving the contingency means that you will be responsible for any difference between the appraisal and the sold price.

An example: The offer on a home is $750,000 and the home appraises for $725,000. In order to close the loan you will have to make up the $25,000 difference if you waived the appraisal contingency.

Inspections

There are a variety of inspections to be done: termite, home inspection, and roof inspections are the most common. The purchase offer calls for 17 days to get these done. The time line to get them done can be shortened to 10 days or 7 days.

Inspections can be waived and done for information purposes only. Any problems found you will deal with after the close of escrow.

Occupancy or when will you take possession of the home

Sometimes the seller needs a few weeks to move out of the home. Asking for immediate possession may be a negative. This is where a good real estate agent can talk to the seller’s agent and find out what the seller needs in an offer. An example on how to use this, you can offer to let the seller stay in the home for 2 weeks rent free to sweeten the offer

Earnest Money Deposit

Read about earnest money here.

Increasing the earnest money deposit to 4% or 5% of the purchase price or more is a way to get the seller’s attention and show the seller how serious you are.

You can make the earnest money deposit non-refundable if you do not close the deal.

There are pros and cons to using these tactics and it all depends on you and your situation as to which ones to use or not use.

If you would like help from a professional real estate broker in this hectic market contact me directly.

Help Me Find a HomeWhat is an escalation clause?

An escalation clause is a condition added to a home purchase offer or counter offer where the buyer says “I will pay x price for this home, but if the seller receives another offer that’s higher than mine, I’m willing to increase my offer to y price.”

How does an escalation clause work?

Generally, the escalation addendum has a few basic components:

Why and when to make an offer with an escalation clause?

Escalation clauses should only be used when the buyer is fairly confident that there will be multiple offers, or when the buyer expects to pay an increased price.

In hot real estate markets, a wide variety of offer-review processes can be available. Some might specify, for example, that the property is going on the market on Friday, and that all offers will be reviewed the following Thursday. The sellers and their Realtor will make a final decision that day.

This situation can be ideal for the escalation clause, when a buyer knows it’s an all-or-nothing offer. Other sellers take a back-and-forth approach.

The escalation clause allows the buyer to make the highest offer but only by the minimal amount necessary to beat out other offers. At first blush, it seems to be a savvy strategy.

Cons Of Using An Escalation Clause

What is earnest money?

Depositing earnest money is an important part of the home-buying process. It tells the real estate seller you’re in earnest as a buyer, and it helps fund your down payment. The earnest money check is typically cashed and held in an escrow account.

Without the requirement of earnest money, a real estate buyer could make offers on many homes, essentially taking them off the market until they decided which one they liked best. Sellers rarely accept offers without the buyers putting down earnest money to show that they are serious and are making the offer in good faith.

Assuming that all goes well and the buyer’s good-faith offer is accepted by the seller, the earnest money funds go toward the down payment and closing costs. In effect, earnest money is just paying more of the down payment and closing costs upfront. In many circumstances, buyers can get most of the earnest money back if they discover something they don’t like about the home and cancel the contract.

How much should you put down in the earnest money deposit?

The amount you’ll deposit as earnest money will depend on factors such as policies and limitations in your state, the current market, what your real estate agent recommends, and what the seller requires. On average, however, you can expect to hand over 1% to 2% of the total home purchase price.

In some real estate markets, you may end up putting down more or less than the average amount. In a market where homes aren’t selling quickly, the listing agent may note that the seller requires only 1% or less for the earnest money deposit. In markets where demand is high, the seller may ask for a higher deposit, perhaps as much as 2% to 3%.

Your real estate agent may recommend that you are more likely to win a bid if you give the seller a large deposit. In fact, the seller may be willing to negotiate on the purchase price a little if you make a bigger good-faith deposit.

When do you make an earnest money deposit, and who holds it?

In most cases, after your offer is accepted and you sign the real estate purchase agreement, the contract stipulates that you give your deposit to the escrow company.

Never give the earnest money to the seller; it could be difficult or impossible to get it back if something goes wrong.

After turning over the deposit, the buyer’s funds are held in an escrow account until the home sale is in the final stages. Once everything is ready, the funds are released from escrow and applied to your down payment.

Can you get your earnest money deposit back?

Whoever holds the deposit determines whether you should get the earnest money back under the terms of the purchase and sale contract. Make sure that the purchase agreement covers how an earnest money deposit refund is handled.

To be on the safe side, make sure the purchase agreement contains contingency addendums that stipulate how a refund is handled (e.g., an inspection contingency protects the buyer if the real estate fails a home inspection). Buyers can also usually get their earnest money back if they find problems with the property, or if they are unable to get title insurance.

A financing contingency ensures that the earnest money is refundable and the buyer can get out of the transaction if he cannot get financing. Keep in mind that a pre-approval from a lender does not guarantee a borrower can get a loan at mortgage rates he can afford. Even if a buyer has a good credit score and is pre-approved for a mortgage loan, the lender can still turn him down based on unforeseen factors such as the appraisal amount being too low. In such cases, a standard contingency allows buyers to renegotiate the purchase contract, or get their money back.

Original Article

A: The primary source of a mortgage lender’s recovery in the event the property owner defaults is the real estate held as collateral, not the owner personally.

To satisfy an unpaid mortgage debt, the lender is forced to first sell the secured property by completing one of two types of foreclosure sales to satisfy the amounts owed:

Occasionally, the fair market value (FMV) of the property is insufficient to satisfy the debt through bidding at the foreclosure sale. If the high bid is less than the debt owed on the mortgage, the lender suffers a loss, called a deficiency. However, to collect on a deficiency, the mortgage lender is very limited in California. The most common type of foreclosure action in California is nonjudicial. When a lender completes a nonjudicial foreclosure sale though a trustee’s sale, they are barred from recovering their loss on the mortgage, except for intentional waste to the secured property.

Further, California has established anti-deficiency laws which bar lenders from collecting losses due to any type of foreclosure sale on a non-recourse debt, also called purchase-money debt.

Nonrecourse debt includes:

Every other type of mortgage is a recourse debt. The homeowner with a recourse mortgage is personally responsible for the payment of the debt. Recourse debt includes:

Business-purpose mortgages secured by any type of property; and

All mortgages secured by a:

When a recourse second mortgage is wiped out by the foreclosure sale of a first mortgage holder, the wiped-out lender may pursue a money judgement against the property owner to recover the debt.

The exception: mortgages insured by the Federal Housing Administration (FHA) and Department of Veterans Affairs (VA) are subject to government recovery of these unpaid mortgage debts and have recourse against the homeowner. However, the FHA and VA rarely pursue deficiency judgments, though they have legal authority to do so.

A: Points paid to a lender on origination of a mortgage are considered interest that is prepaid as it has not yet accrued as earned by the lender. Points essentially buy down the mortgage’s interest rate from par for the life of the mortgage.

When no points are paid or taken by the lender as a discount on origination of a mortgage, the interest rate stated in the note is the par market rate.

Depending on the purpose for obtaining mortgage funds, points are deductible for income tax reporting, either:

• fractionally throughout the life of the mortgage;

or

• entirely in the year the mortgage is originated.

The general tax reporting rule for expensing interest, unless excluded from the rule, is that only the fraction of the points paid which accrues each month over the life of the mortgage, called the life-of-loan accrual, may be deducted against that year’s income.

In the year a mortgage is satisfied by prepayment, any prepaid interest not yet accrued — undeducted points — may then be deducted. Excluded from the life-of-loan accrued reporting treatment is interest paid on a mortgage which finances:

• the purchase of an owner-occupied primary residence;

or

• home improvements made to an owneroccupied primary residence.

The entire amount of points paid on a mortgage funding the purchase of the home you will occupy — not a second or vacation home — is allowed as a personal deduction in the year the mortgage is originated.

This immediate deduction applies to all points paid in connection with the mortgage which finances the purchase or improvement of your primary home.

When your lender pays the points as a discount or an add-on to your mortgage, the points — as prepaid interest withheld by the lender — need to be deducted annually as they accrue over the life of the mortgage.

Your tax preparer knows how to report your points as a personal deduction.